As of the end of 2025, Greece’s Golden Visa programme supports 79,056 valid residence permits. This is not just an annual figure — it reflects the accumulated scale of the programme over time. Of these permits, 27,786 belong to principal investors and 51,270 to family members, confirming that the scheme operates mainly as a family-based residency channel rather than as an individual investment tool.

It is important to note, however, that valid residence permits do not necessarily correspond to full-time physical residence. The Golden Visa framework does not impose a minimum stay requirement, meaning that some permit holders may reside in Greece part-time or maintain residency primarily for mobility and asset diversification purposes.

The composition of this active base is revealing. Around 78% of permits are initial grants, while 22% are renewals, meaning that a significant number of investors have now entered their second residency cycle. In other words, the Golden Visa is no longer defined only by new entrants; it is increasingly sustained by investors who choose to remain.

At the same time, the administrative pipeline remains sizeable. There are 11,553 pending investor applications, while 40,372 total Golden Visa–related cases — including family members — are still under examination. The programme therefore combines long-term scale with ongoing processing pressure, a profile that reflects maturity rather than rapid expansion.

These figures define the current phase of Golden Visa trends in Greece. To understand where the programme stands today, however, one must also look at annual applications.

For readers evaluating the Golden Visa as part of a broader relocation strategy, our complete guide to Moving to Greece in 2026 explains how investment-based residency connects with tax registration, healthcare access, banking setup and long-term settlement planning.

Applications: The Surge and the Adjustment

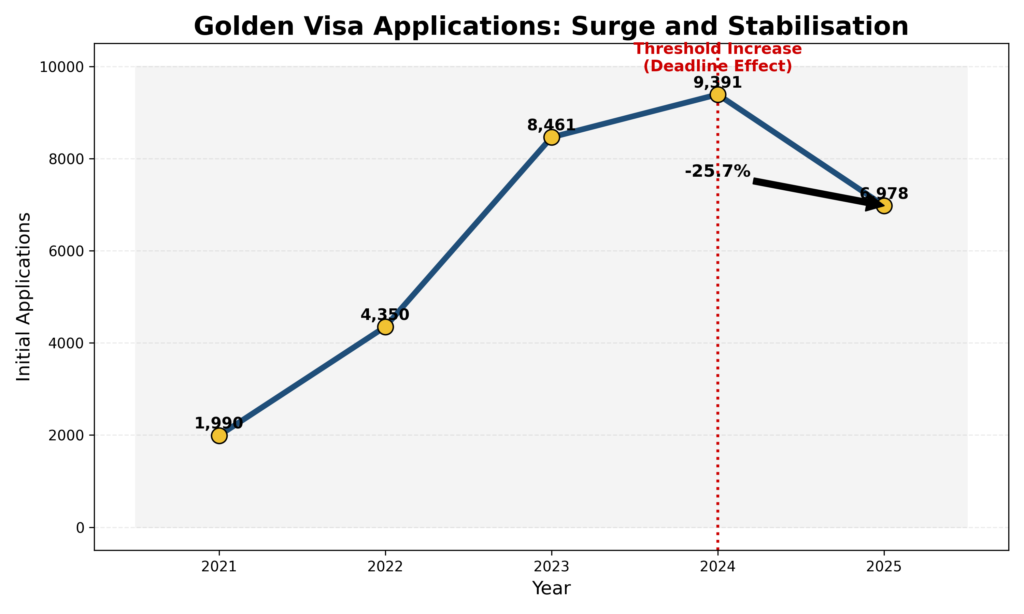

Between 2023 and 2025, initial investor applications were:

- 2023: 8,461

- 2024: 9,391

- 2025: 6,978

At first glance, the –25.7% decline between 2024 and 2025 may appear significant. But context matters.

The 2024 peak coincided with the introduction of higher investment thresholds under Law 5100/2024 (Government Gazette A’ 49/5.4.2024). Many investors accelerated their applications to secure residency under the previous, lower thresholds. This created a temporary spike.

Once the new pricing structure came into force, application volumes naturally adjusted. Even so, 6,978 applications in 2025 remain well above pre-surge levels (4,350 in 2022 and 1,990 in 2021). Demand has not collapsed; it has stabilised.

The pattern is therefore clear: growth, acceleration, policy-driven spike, and then adjustment to a new normal.

Golden Visa initial applications (2021–2025). Data: Ministry of Migration & Asylum; visualisation: xpat.gr.

The 2024 Reform: Higher Thresholds, Different Entry Routes

The turning point came with the 2024 reform of the real estate pathway.

The new framework introduced:

- A €800,000 minimum investment in prime areas such as Attica

- A €400,000 minimum investment in other regions

- Single-property and size requirements in €800,000 zones

These changes raised the level of capital required, especially in high-demand urban markets.

At the same time, the law preserved €250,000 investment routes for:

- Converting industrial or commercial buildings into residential use

- Restoring listed or heritage properties

The effect was not to close access, but to reshape it. Investors now face clearer segmentation: higher capital for prime residential assets, moderate capital for regional investment, and lower thresholds for regeneration-focused projects.

Other investment-based residence options exist under the Migration Code, but the 2024 real estate reform has clearly shaped investor behaviour over the past two years.

Approvals: A Year of Processing

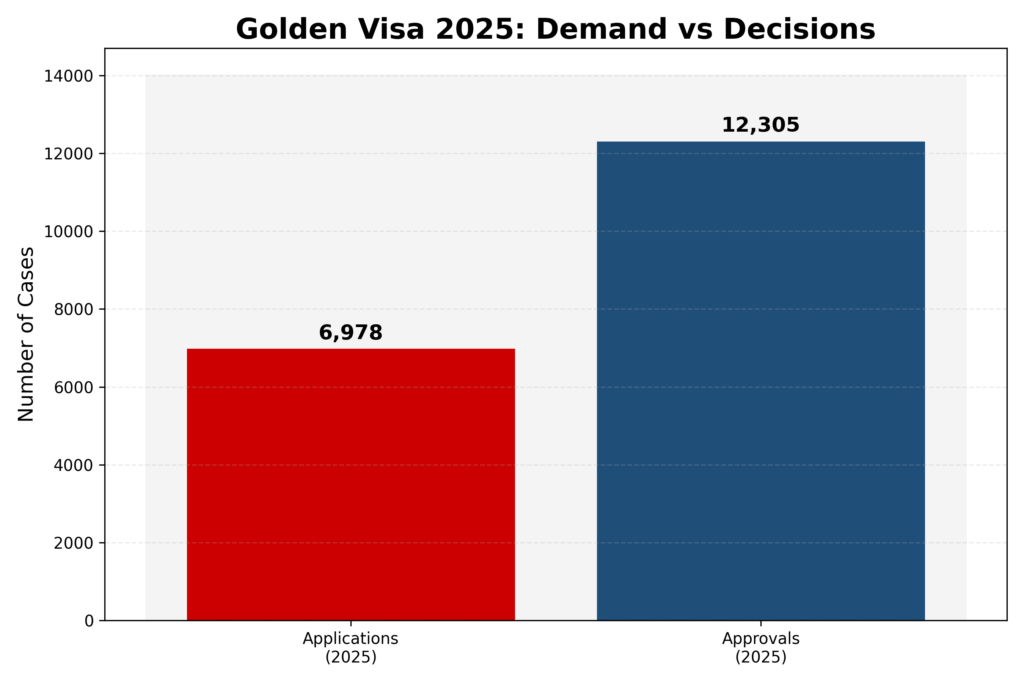

While applications moderated, approvals moved in the opposite direction.

In 2025 authorities issued:

- 9,382 initial approvals

- 2,923 renewals

- 12,305 total decisions

This reflects a marked increase in administrative throughput.

The contrast between 6,978 new applications and 12,305 approvals shows that 2025 functioned largely as a processing year. The administration cleared cases accumulated during the surge phase of 2023–2024.

This helps explain why the active stock of permits continues to grow even as annual applications have stabilised.

Applications versus approvals. Data: Ministry of Migration & Asylum; visualisation: xpat.gr.

The visual gap underscores the transition: administrative output exceeded new inflows, reflecting consolidation rather than renewed expansion.

Who Is Applying? A Broader Investor Base

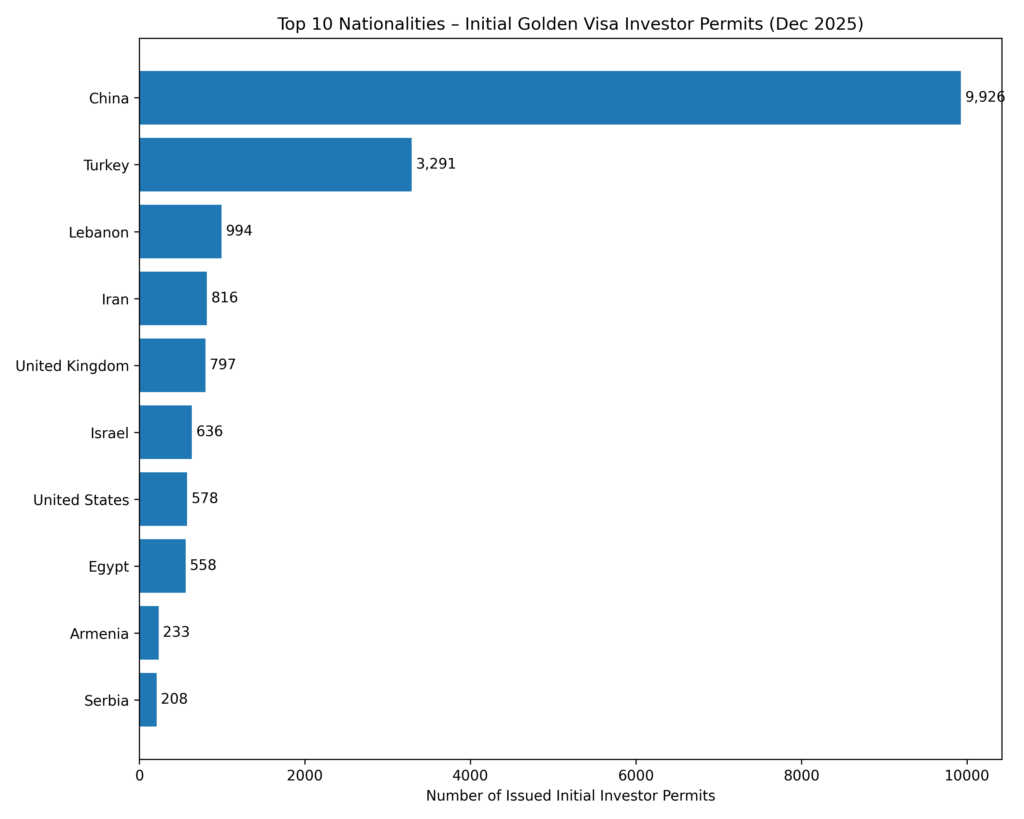

The Ministry’s December 2025 data show the following breakdown of issued initial investor permits:

- China – 9,926

- Turkey – 3,291

- Lebanon – 994

- Iran – 816

- United Kingdom – 797

- Israel – 636

- United States – 578

- Egypt – 558

- Armenia – 233

- Serbia – 208

China remains the largest investor group, although its dominance is less overwhelming than in earlier years. Turkey has strengthened its position, while participation from the Middle East, the UK and the US shows that demand now comes from a broader set of economic and geopolitical contexts.

Some investors appear motivated by regional instability or currency concerns. Others are seeking diversification within the eurozone or mobility access within the Schengen area.

The Golden Visa no longer depends on a single nationality. Its base is wider and more varied than during its earlier expansion phase. For readers evaluating the Golden Visa as part of a broader relocation strategy, our complete guide to Moving to Greece in 2026 explains how investment-based residency fits within tax residency, healthcare registration, banking setup, and long-term living considerations.

Golden Visa permits by nationality. Data: Ministry of Migration & Asylum; visualisation: xpat.gr.

Where Is Investment Concentrated?

Geographically, the programme remains heavily concentrated in Attica.

Of the 11,553 pending investor applications, 9,095 are located in Attica, representing nearly 79% of the total backlog.

The rest are distributed across other regions in much smaller numbers.

This concentration is notable given the €800,000 threshold applied to prime areas. Even at higher entry levels, investors continue to favour Athens and its surrounding areas.

The availability of €250,000 conversion and restoration routes has not significantly dispersed activity. Many regeneration projects remain urban, reinforcing metropolitan concentration rather than shifting capital to less developed regions.

In practical terms, investors continue to prioritise liquidity, rental potential and resale prospects over lower entry prices in less central markets.

From Rapid Growth to Structural Stability

Taken together, the data suggest that the Golden Visa programme has moved beyond its rapid growth phase.

Applications are lower than their 2024 peak but remain historically strong. Approvals reached record levels in 2025. Renewals account for a meaningful share of active permits. The investor base is more diversified. And the programme supports 79,056 valid residence permits at scale.

The 2024 reform appears to have reshaped the profile of participants. The €800,000 tier limits prime-area access to higher net-worth individuals. The €400,000 tier attracts regionally flexible investors. The €250,000 regeneration pathways draw those willing to engage in structured redevelopment projects.

The result is not contraction, but adjustment. Annual volumes have cooled from their peak, yet the programme is now more capital-intensive and more embedded within Greece’s migration and property landscape.

Whether this balance proves durable will depend on broader economic conditions, property market performance and administrative efficiency. For now, Greece’s Golden Visa appears to have entered a phase of structural stability within a more clearly defined framework.

Investors considering entry in 2026 should assess not only capital thresholds, but also practical relocation steps, tax positioning and long-term residency planning, all covered in our comprehensive Moving to Greece in 2026 guide.

📊 Greece Golden Visa Trends — At a Glance (End-2025)

79,056 valid residence permits in force

→ 27,786 investors

→ 51,270 family members

22% of active permits are renewals

→ Retention is now structurally embedded

6,978 new investor applications in 2025

→ –25.7% vs 2024 peak

→ Still well above pre-2023 levels

12,305 approvals issued in 2025

→ Highest annual total on record

→ 2025 largely a processing year

11,553 pending investor applications

→ 79% concentrated in Attica

Investment thresholds shaping behaviour:

- €800,000 – Prime zones (incl. Attica)

- €400,000 – Other regions

- €250,000 – Conversion & restoration projects

🔎 What It Means

The programme is no longer in a surge phase.

Volumes have moderated, capital requirements are higher, and the investor base is broader.

The Golden Visa now operates at structural scale rather than rapid expansion.

Sources:

- Greek Ministry of Migration & Asylum (data as of end-2025), Greek Government Migration Statistics — https://migration.gov.gr/en/statistika/